Last week at both the Independence County Quorum Court and Batesville City Council meetings, years-long contention about the distribution of county jail fees and other “county vs. city” items resurfaced.

At last Monday’s quorum court meeting, Sheriff Shawn Stephens reported to the justices of the peace that his department would not be able to provide raises to his employees if a proposed salary increase was passed. Instead, the sheriff said, he would have to provide comp time, which would leave the jail and police department short-staffed. This prompted one JP to respond by calling for the court to pursue unpaid debts for the jail owed by the City of Batesville.

When asked to explain Batesville’s legal obligations to pay the debts, County Attorney Daniel Haney explained that although there was no official record of an agreement between the county and Batesville, there was still “a legal obligation” for the city to pay.

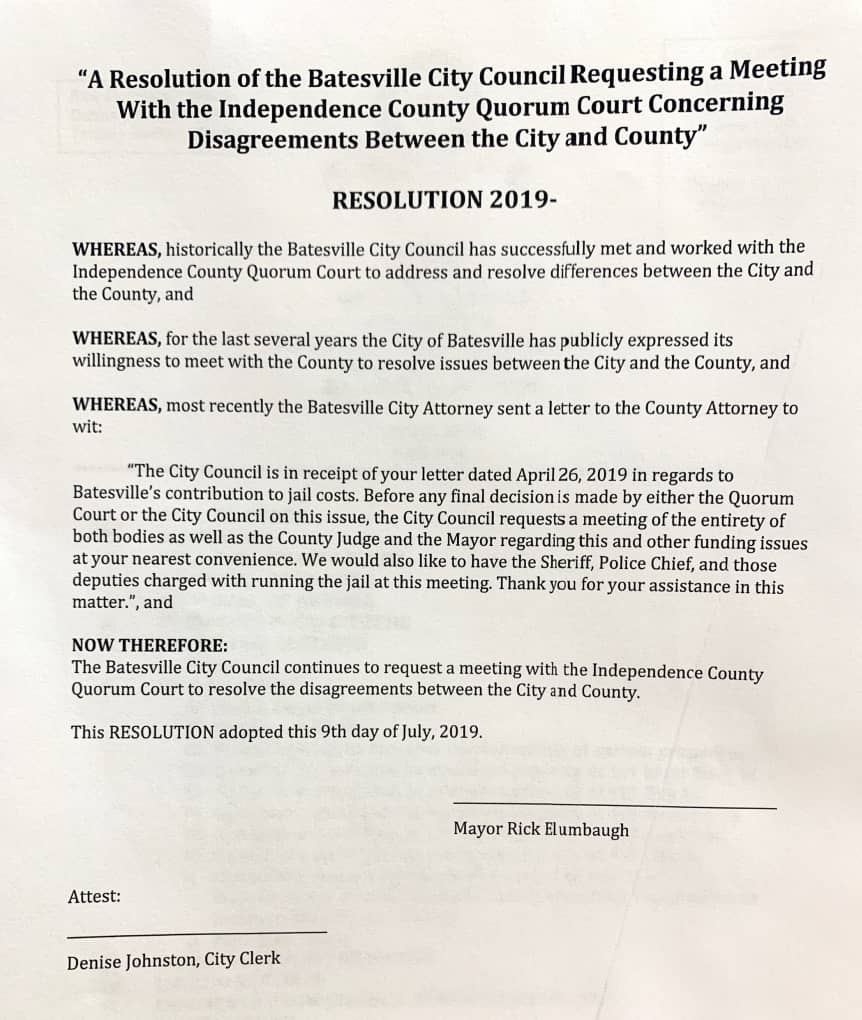

Haney noted a letter was sent on April 26 to Batesville attorney Tim Meitzen proposing a payment solution. The city responded by requesting a meeting.

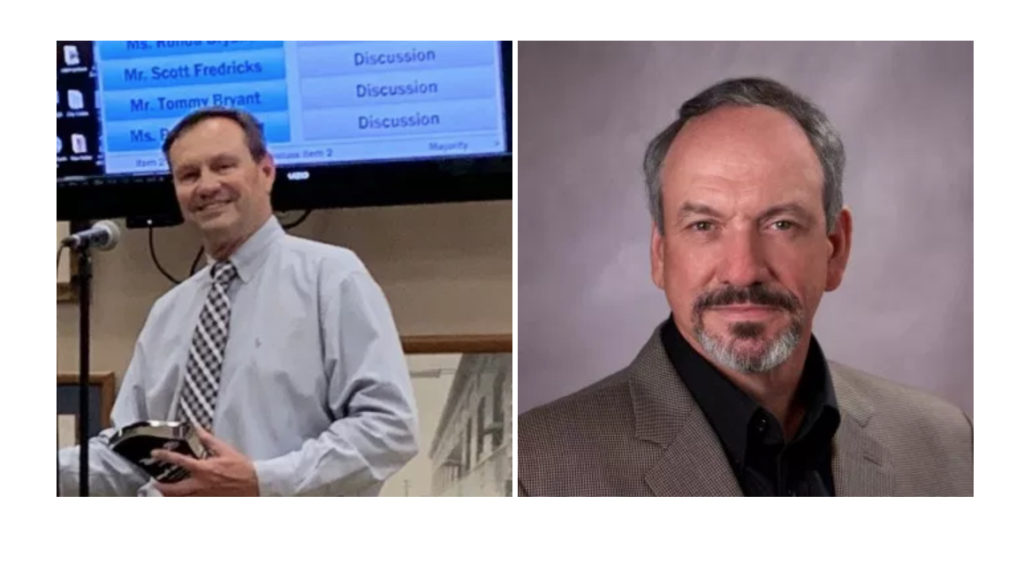

At the Monday quorum court meeting, County Judge Robert Griffin (pictured, right) said, “There need to be specific things to talk about.”

The court ultimately moved for Haney to send another letter to the city with a formal agreement requiring signatures attached.

(Click here for more info on the July 8 meeting of the Independence County Quorum Court.)

At Tuesday’s Batesville City Council meeting, Mayor Rick Elumbaugh (pictured, left) commented on a resolution (see below) that unanimously passed calling for a meeting with the county to discuss and settle differences in funding of the district court, jail, and recycling. (Click here to listen to his comments.)

Later last week, Independence County Judge Robert Griffin said the county is just following the law and written agreements when it comes to the distribution of district court fees and issued the following statement regarding the differences between the county and city governments:

“I don’t understand the Mayor creating conflict, when the County has said we would be happy to meet. For anyone that has been a part of discussions such as this, having a preset and limited agenda is the only way for productive talks. I simply can’t understand why the city administration is not willing to put in writing their concern, what they wish done and justification under the law for the action prior to meeting. The County would then respond and then we would meet on an issue.

“In the spirit of cooperation, let me suggest that since the QC [quorum court] members come from far and wide, and the Council is all local, that we set a meeting just after the QC monthly meeting with one item to consider and proper written notice as above be given beforehand. We can do this each month until the docket is cleared and take on one issue at a time. We have brought forth out issue and law for nonpayment of jail reimbursements and I would expect that to be the first issue discussed.”

On Thursday, White River Now received a statement from Batesville City Councilman Chris Poole regarding the disagreement:

“I would like to take this opportunity to provide some additional detail regarding the jail fees that Independence County contends are owed by the City of Batesville to the County. I contend that this is just the latest instance in a pattern of unfair treatment of the citizens of Batesville by the Independence County Judge and Quorum Court. To fully grasp the issue one must understand the history leading up to the current situation, going all the way back to the 1982 one-cent countywide sales tax. Accompanying that tax was a resolution of the Quorum Court (60-82). Part of that resolution outlined agreements between the County and the municipalities in the county to address inequities by distributing monies to said municipalities for various needs. Importantly, one of the stipulations in Resolution 60-82 was that every city in the county was to receive from the county the equivalent of half of the 3 Mill road tax collected from the property owners within each city. By law, the County must remit half of the 3 Mill road tax to the cities; the agreement in the resolution is in reference to the remaining half. In Batesville’s case, that amounted to approximately $150,000 annually, which the City included in its budgeted revenues each year. It should be noted that Resolution 60-82 also included an agreement prescribing the manner in which municipalities would contribute funding to the predecessor of the District Court. Furthermore, the resolution also specified that the City would pay no jail fees in exchange for its support of the countywide tax. This resolution was the result of an agreement between the County, the City of Batesville, and other municipalities in the County. The resolution was modified by the Quorum Court over the years, but in a 2015 resolution (2015-06), the Quorum Court revoked Resolution 60-82. After Resolution 60-82 was revoked the Quorum Court voted to cut those funds to Batesville, while every other municipality continued to receive said funds.

Also in 2015, it became apparent that the County Jail was in dire need of funding. This situation was likely exacerbated by the dissolution of the Interlocal Law Enforcement Agreement between the County and the City of Batesville, which occurred at the end of 2014. After revoking Resolution 20-82, later in 2015 the Quorum Court requested that each municipality contribute 30% of its fine money collected from District Court to support the operation of the jail. According to the Guard report from the July Quorum Court meeting, the amount that this represented for the period of May 2015 – March 2017 was $68,588.03

Prior to 2017, the City of Batesville contributed funds to the County to support a share of the costs of District Court, at the rate prescribed in Resolution 60-82. However it should be noted that due to the revocation of Resolution 60-82, no formal agreement existed defining contribution obligations; and Arkansas State Law is ambiguous regarding those obligations. When developing the 2017 budget, the Batesville City Council chose not to include funding in the budget to cover its prior practice of contributing to District Court costs. This was at least partly in reaction to the loss of the aforementioned road tax money. Based upon the last full year that Batesville contributed to the costs, the amount that the county would have received from the City of Batesville for District Court costs in the period of May 2017 – March 2019 was $179,179.84.

Subsequently in June 2017, under a court order from Judge Taylor, the County began to retain the entirety (100%) of the City fine money obtained from District Court. Based upon the figures reported in the Quorum Court meeting report for the period of May 2017 – March 2019, the total amount of money that the County retained from City fines would be $228,626.76. Furthermore, the City ceased to receive Justice Fund monies, which amounted to $2,933.03 per month and would have totaled $64,526.66 in the period referenced. Taken together, this amounts to at least $293,153.42 that the County has retained in relation to the District Court matter.

As was described in the Guard report on the Quorum Court meeting, the City did not provide 30% of City fines after May 2017; it must be emphasized that this was subsequent to the County retaining all of the City’s fine money from District Court. Taken together, the amount that the City would have paid the County under the prior practice would have been $179,179.84 for District Court costs plus $68,588.03 for jail cost resulting in a total of $247,767.87. As stated above, the amount that the County has retained is at least $293,153.42. This means that the County has benefited by at least $45,385.55 from this situation. Astoundingly, it seems that the County Judge and the Quorum Court have sought to imply that this represents an underpayment of the City’s obligations. As a member of the Batesville City Council, I feel that this is not fair to Batesville residents, and it represents a pattern of unfair treatment of the citizens of Batesville. This is why the Council has again requested a meeting with the Quorum Court and County Judge to attempt to consider all of the issues and arrive at an equitable solution.”

White River Now will continue to track this story and release new information as it becomes available.

We hope these exchanges will help you better understand the issues and operations of your government.

Get up-to-date local and regional news along with the latest sports and weather every weekday morning by listening to Gary B. and Ozark Newsline on Arkansas 103.3 KWOZ. White River Now updates are also broadcast weekday mornings on 93 KZLE, Outlaw 106.5, and 99.5 Hits Now. If you have a news tip or event to promote, email White River Now at news@whiterivernow.com. Be sure to like and follow White River Now on Facebook, Twitter, and Instagram.

Get up-to-date local and regional news along with the latest sports and weather every weekday morning by listening to Gary B. and Ozark Newsline on Arkansas 103.3 KWOZ. White River Now updates are also broadcast weekday mornings on 93 KZLE, Outlaw 106.5, and 99.5 Hits Now. If you have a news tip or event to promote, email White River Now at news@whiterivernow.com. Be sure to like and follow White River Now on Facebook, Twitter, and Instagram.